Setting the Table:

Futures are lower this morning for what feels like the first time in weeks. After NDX hit an all time high yesterday, we continue to see volatility leak out of the market. SPX is a tick away itself, and in this case both IV and HV are falling fast.

As we can see for the last two weeks, this has produced positive VRP readings that are fairly significant for the index. The mean over the last two years is closer to 1.7%, yet we nearly doubled that last week.

The difficulty with a VRP strategy in this market however, is that your result will be heavily influenced by delta. If you’re short condors, straddles, or any other VRP collection strategy, you’re getting more than just short vol.

On 4/29, SPY closed at $510, and the 510 strike straddle expiring on 5/31 was worth $15.80. That puts your breakeven at $525.80 and $494.20.

SPY closed yesterday at $529.81, and that straddle is now worth $20. Even though you sold 12.9% vol, and the realized vol has been 10.7% over the period, you’re down quite a bit on that position.

Hold on tight though, SPY is down $3 this morning - anything change with time on the clock!

Covered Calls (COVC) - High Premiums, High Dividends

This week we continue our focus on dividend stocks to screen for opportunities. Whether you’re using the GULL for hedged equity (as discussed yesterday) or a basic covered call, there are numerous similarities in the use of the Screener.

I made a small clarification post for the BITO dividend yesterday. Thanks to a reader question, I want to clarify what’s going on there. While the distributions might be high, I prefer to model this as a negative rate due to the structure of the fund.

Dividend paying stocks and high covered call values are a good combination to produce cash flow. The caveat of course is that dividend yield rates can be high due to falling stock prices, and the high volatility you’re selling is likely bid up for a reason.

As with all strategies, its important to remember what your delta exposure is here. You’re likely to win as much because of the stock’s price action, as what the cash flow components are here.

Today’s screen will focus on the following: high dividend yield, high COVC30 value, and lower VRP readings. When looking for income producing assets, we like the high vol that comes with COVC, but we use VRP as a measure of how accurate those readings are.

Opportunistic: RILY

At the top of our screen today we see RILY - long an opportunistic name for trading all sorts of income strategies.

The indicators look tempting here. A quarterly dividend of roughly 1.5%, alongside the potential to collect another 6.7% from a 90 day covered call. If you wanted to be more aggressive you could sell twelve time a year for 3.6%.

Volatility is high here - but it’s been coming down quite a bit. Historicals over 90 days are 122%, but current 90 day is only 81%. ATMVol has likely come down because VRP over the past 90 days was almost 51% points. If you believe vol is going lower, than a covered call sale could be opportunistic here.

Fair warning to be suspicious about the dividend here. While they just declared another $0.50 dividend, this is a far cry from what they’ve been paying the past few years.

Another question here as we look towards implementation is strike considerations for either 30 or 90 days. RILY is busy, but past the front weeklies, there’s only 50 and 141 day expirations listed.

The plus side of going shorter means that there are more intervals to reset if this hits a trend.

Further, we have strikes listed every $0.50, providing granularity at the 27, 29, and 32 delta level.

Fundamental: MPW

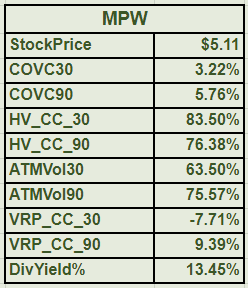

Looking at the results through a fundamental lens, we might find some value opportunities in a name like MPW.

The dividends here are very high as it’s a REIT, but it also comes with particularly high volatility recently. 30 and 90 day historical vol are in the 80% range, and VRP has been chopping around - slightly negative at 30 days, slightly positive at 90.

Like the rest of the market, current implied volatilities are lower than historicals. Depending on your bullishness, this might be cause to either pause or set strikes closer to the money.

Here a word of warning for strategy execution is that strike listings are hard with a low dollar stock. The 5.5 strike 29 days out is our closest match, but if you want to go up to the 6 strike you’re down to 17 delta and half the premium.

Subscribe now to see the full screen below….

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.