Hedged Equity (GULL): VZ vs. BITO

Comparing how strike selection matters in low vol, high dividend stocks

Setting the Table:

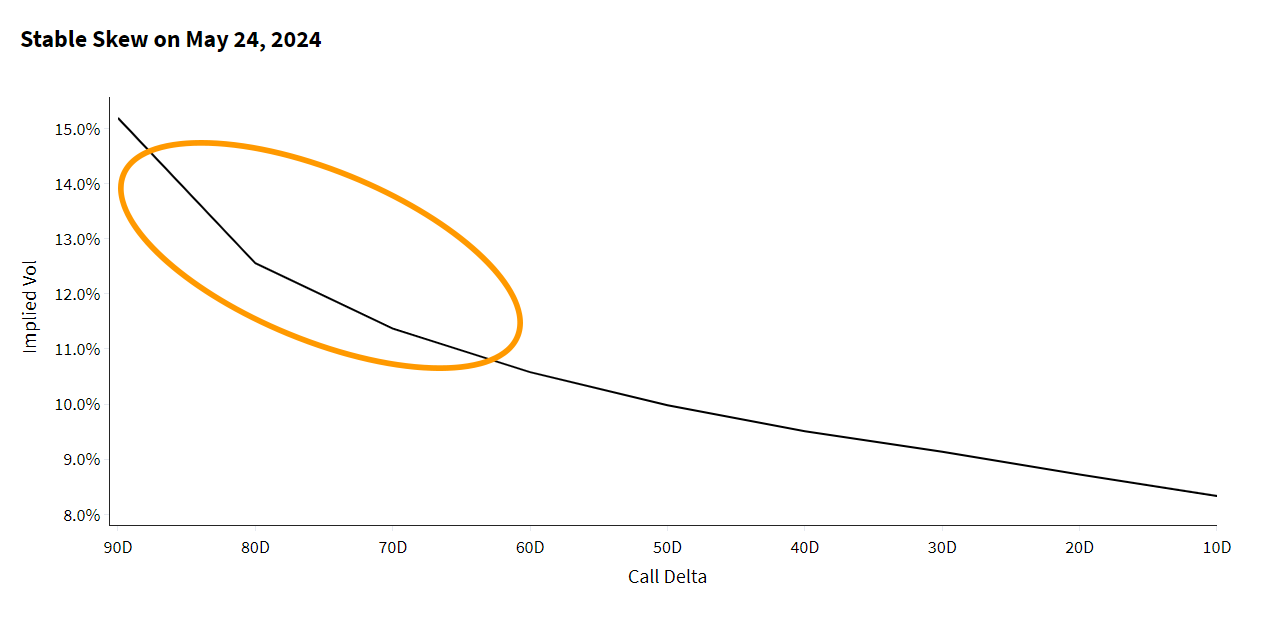

Vol has been sinking for a while, but it was only after Friday’s session that our benchmark 30 day ATM vol figure for SPY slid into single digits.

The VIX reference point is still trading at 13.40, which is low, but higher than ATM because of the calculation method. VIX uses a strip of options, which include many downside strikes priced quite a bit above the OTM.

QQQ liquidity has been outperforming SPY recently, and the relationship between stock price and volatility is a perfect description of the past month. Stocks are going up and to the right, and implied volatility at both 30 and 90 days continues to move in lockstep the opposite direction.

Other than a few spikes, volume has been trending downwards into the summer slump. This is worth noting relative to implied volatility, as it’s taking fewer contracts to move the levels significantly (lower). With a bit of a catalyst, that means levels could move quickly.

Volatility tends to behave in the opposite way from equity markets; it takes the stairs down, but a quick elevator up.

Hedged Equity with the GULL:

For this week’s GULL screens, we’re going to focus on opportunities that will protect high dividend paying stocks.

The GULL position is a defensive overlay for high dividend paying names that mitigates the equity risk while providing cash flow from distributions.

One of the pieces of options pricing intuition to remember here, is that dividends reduce the forward value of the stock. Calls are priced lower and puts higher, because knowing the company will distribute cash, the price at settlement is lower.

One of the first items to pay attention to when creating GULL spreads is that you’ll need to find three appropriate strikes to trade the position. Not only is there a put spread that needs to line up for your desired protection, the net debit of this must be matched by a call that is appropriately priced.

While their dividends are unlikely to be consistent, BITO is paying a healthy ~5% annualized. Especially with high volatility a GULL is desirable, but the market widths and strike listings mute any benefits.

Update (5/29):

The framing of BITO’s dividend as 5% is likely confusing - and not wholey accurate. BITO has in fact distributed quite a bit of income over the last 15 months - $5.15 for a $28 stock. And if you look at the last distribution of $1.68, it annualizes to over 70%.

While that does mean cash to holders in the traditional dividend sense, from an exposure perspective, investor’s proxy to Bitcoin itself has changed quite a bit. In January 2023 a BITO shareholder had financial exposure to approximately 6.3bps of BTC. Today they only have 4.1bps of exposure.

Much of this comes from the futures exposure, and the premiums paid versus spot. At one month it’s roughly 12% annualized, but this varies quite a bit. So while they are distributing cash for various reasons, there is a real negative rate exposure versus the underlying they’re trying to track.

Given that BTC is not a productive asset, I think this makes more sense to model as a light dividend, with a very significant negative rate, rather than as the large distributions that are paid. Both will effect the cost of carry, but the structure of a negative rate feels more appropriate here.

In September, $0.50 to $1.00 wide spreads - worse in the puts - make execution very expensive across three legs. There may be improvement potential, as the expiration has decent OI across ATM strikes.

We’re going to focus this screen on scenarios where the GULL90 value is on the low end (generally also lower volatility names) , but also where the dividend rate is robust. We’ll also compare historical and implied vols at the same tenor in which we’re filtering.

For analysis and demonstration (not a recommendation) we’ll compare this to what’s happening with Verizon.

Currently trading $39.72, the 90 day theoretical GULL gives you 5.09% upside, and an annualized dividend of 7.22%. Implied volatility is closely priced to historicals, and long term VRP is fairly flat. Qualitatively, we can say in vol space this tends to deliver on expectations.

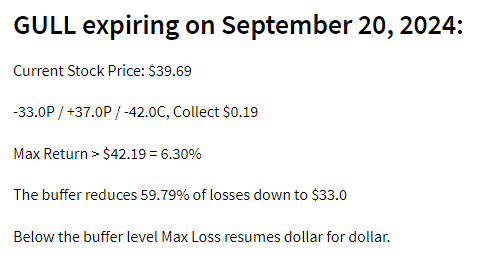

Moving from an interpolated value with the indicator to an actual spread, the closest our StrikeFinder gets is the below:

As you can see the upside here is higher when we get down to actually best strike setups - up to 6.3% upside once the net credit is accounted for. Most of this however is due to put selections. In September, there’s only the 37/35/33 strikes listed. That means on the downside our starting put has to be roughly 7/12/17% out of the money. The nearest far put then is somewhere between 12/17/24% OTM.

This creates an important decision point for traders. We can bring the tenor in to only 51 days out in July, but that’s a very different looking spread. The best match in that expiration only has a GULL reading of 3.19%.

For setting put legs, pushing the spread further OTM will give you more upside but also downside risk. If you’re more aggressively bullish and can handle a worse worst case, by all means take the upside.

On the call side, we see the same strike selection problem and choice about how much to pay for potential gains. At 42 we see a small credit, and going up to 45/47 lets you pay $0.33 or $0.45 now to get $3 or $5 of potential energy.

Execute:

A major difference between the two choices highlighted here (BITO vs. VZ) is the spread width.

Open interest will dictate the amount of price improvement you can hope for.

Strike choices are more granular in BITO, but despite that VZ offers better customization because of liquidity.

Subscribe now to see the full screen below, along with all access to TheTape.Report

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.