Who knocked out the VIX?

BIS and CBOE analyze whether derivative income funds are impacting VIX levels

Setting the Table:

Flows have been digestive this week, with both SPY and QQQ roughly flat. The VIX is lower, as another CPI print is out of the way and all eyes pivot back to the Fed decision on Wednesday.

Comparing this term structure in the SPX straddle to GARCH, we see there’s a bit of event vol going into next week, but that’s roughly in line with the premiums we’ve been seeing over the past few weeks. GARCH still doesn’t believe this “upside vol” grind, it has too long of a memory.

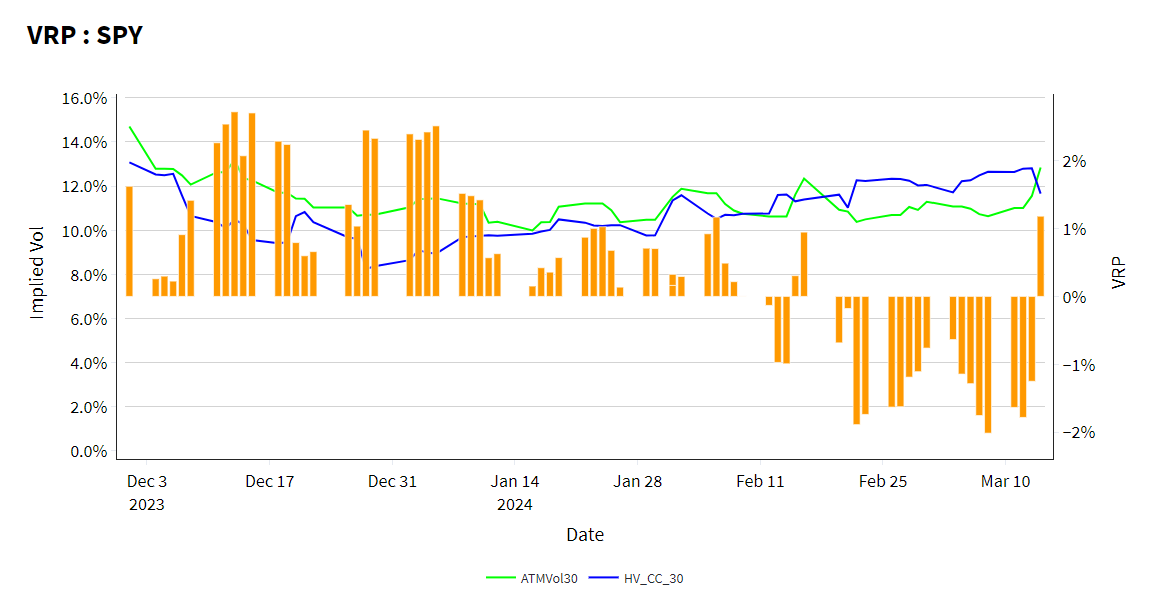

For the first time in almost a month, VRP ticked back positive yesterday for the SPY 30 day measure. It’s unusual for this measure to stay negative for so long, and while ATM vol has risen, more of this is historical volatility settling as the rate at which the market is rising has slowed.

Remember this is a backward looking measure - the change registered yesterday, but the volatility adjustments happened a month ago.

While VRP uses the rear view mirror, we now have a measure of the current reading in the Screener - IVNetHV. The green line represents the current implied vol, minus the historical vol, here both at 30 days. The red bars show what the prior 30 days of VRP looked like.

As implied volatility has broadly come in over the past year, so have both the VRP levels, and the forward looking difference.

Identify:

Negative VRP either means historicals are overpriced, or implieds are underpriced. For individual names we typically think of the scenario where historicals are too high, a big outsized move that happens. Guess when NVDA had earnings?

While the pricing mechanics are the same in single stocks and indices, the types of customers are different. The high liquidity and macro exposure provided by a product like SPX make it a playground for large customers to generate options income. They do this by selling volatility, and allegedly the surplus here pushes implieds too low.

This strategy has only gotten more popular recently, and we have not only the institutional sellers, but a bevy of ETFs that make this strategy accessible, combined with market structure (0DTEs, strike listings) to facilitate that.

The broadly cited concern here is that there is too much short volatility exposure. People willing to sell options at negative VRP. This increases the risk of a “Volmaggedon” type blow out, and the unwinding of leverage will wreak havoc on the markets. And if not a blow out, is there a more paradigmatic shift in the markets - does the accessibility of a short vol trade suppress the levels of the VIX below its “appropriate” value?

As we’ll dig into below, I think not. Much of this derivatives exposure is currently coming from covered calls and the product structuring of short exposure has significantly improved. Further, there’s nothing particularly disturbing in skew or overall implied levels.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.