VRP + Liquidity, Where Go Thee?

How implied volatility levels relate to liquidity and future variance

Setting the Table:

Yesterday saw markets bounce back after a choppy week with a glimmer of rate cut hope coming out of Chairman Powell. Week over week we’re close to flat (but rising) with the indices digesting these levels of both underlying and volatility. Higher unemployment and lower earnings growth has traders excited this morning.

In a few editions of Trading Opportunity this week, we pointed out how the skew surface has changed in SPY/SPX. Heading into the week we saw calls bid as the indices were floating towards highs. That’s shifted however.

The tango between implied and realized continues, as implied vol just can’t seem to rise to meet the levels of stock movement. The blue line consistently tracks below the black realized line, and while 10 day VRP has always been a tough capture, this short dated relationship isn’t always so one directional.

We expect 30 day VRP to be much more stable, which it is, though also distinctly negative (yellow over pink) and has been for three weeks.

Some of this might be due to the notorious “vol suppliers” that indiscriminately sell options regardless of implied level to generate income. Retail is an influence here, but much of the true supply is coming from institutional mandates. Or sometimes the weighing machine just needs recalibrating.

In fairness to what sounds like an un-reactive implied vol surface, at 30 days the curve is currently trading over a full point and a half higher ATM compared to the prior ten days in SPX/SPY.

Identify:

This persistently negative VRP is an interesting phenomenon because it suggests that options sellers are offering too cheaply. We could say the same in the opposite direction - that typically options buyers are more often paying too much - but that paradigm of “overpaying for insurance” is both normalized and reflective of the fact that pure sellers are exposed to the kurtosis of returns.

The SPX is up 9% this year, but there haven’t exactly been “outsized” moves. Three down moves over 1%, none worse than 2%, and five up moves over 1%, including Feb 22nds 2.07% FOMO rally.

Liquidity and volume that create a dynamic where buyers don’t overpay and sellers don’t undersell is one way to define an efficient market. With billions of dollars of capital moving every minute in equity options, we would expect the invisible hand to quickly find a long term equilibrium.

We see this balance is typically fairly positive. It’s only been since Nov 2023 that the trend has been persistently down. Options just keep getting cheaper relative to market movements.

At TheTape, the measure of liquidity we use is the LIQ index. It’s a weighted score that combines market width, volume, and open interest to relativize the liquidity in the top 250 most active names. The more liquid something is, the more likely you are to get a fair current price. Thinly traded names will not only be more difficult to execute - particularly multi legged strategies - but the current pricing is more likely to be incorrect.

A tight spread is great for entry and exit, but how fair is the price you’re paying for volatility? In other words, does better liquidity imply better pricing of the future path of the option?

If we compare the average liquidity scores over the past year to the average VRP in a name, we can see a strong relationship. There is a much tighter range of VRP values for the liquid names than the less liquid names.

Names that are under 50 in LIQ have a wide range of VRP values - mis-priced by more than 25 vol points in some cases - but that band tightens as it approaches scores of 100, and moving right into the Mag7 and indices of the world we see very tight VRP levels.

Analyze:

The relationship between LIQ and VRP makes intuitive sense. Dealers will provide tighter spreads and customers will trade more volume when they are confident in the pricing. A bid-ask spread is a standard error bar, and if the collective hive mind of options traders is highly confident, they’re usually right.

An important point about the data. Values like LIQ and ATMVol30 will be “todays” value. The VRP value looks at the ATMVol30 figure, and then compares it to what happened in the future 30 days for historical vol. We only know after 30 days, how well the last 30 days were priced. So on March 8th, we can only know how well the February 8th values performed.

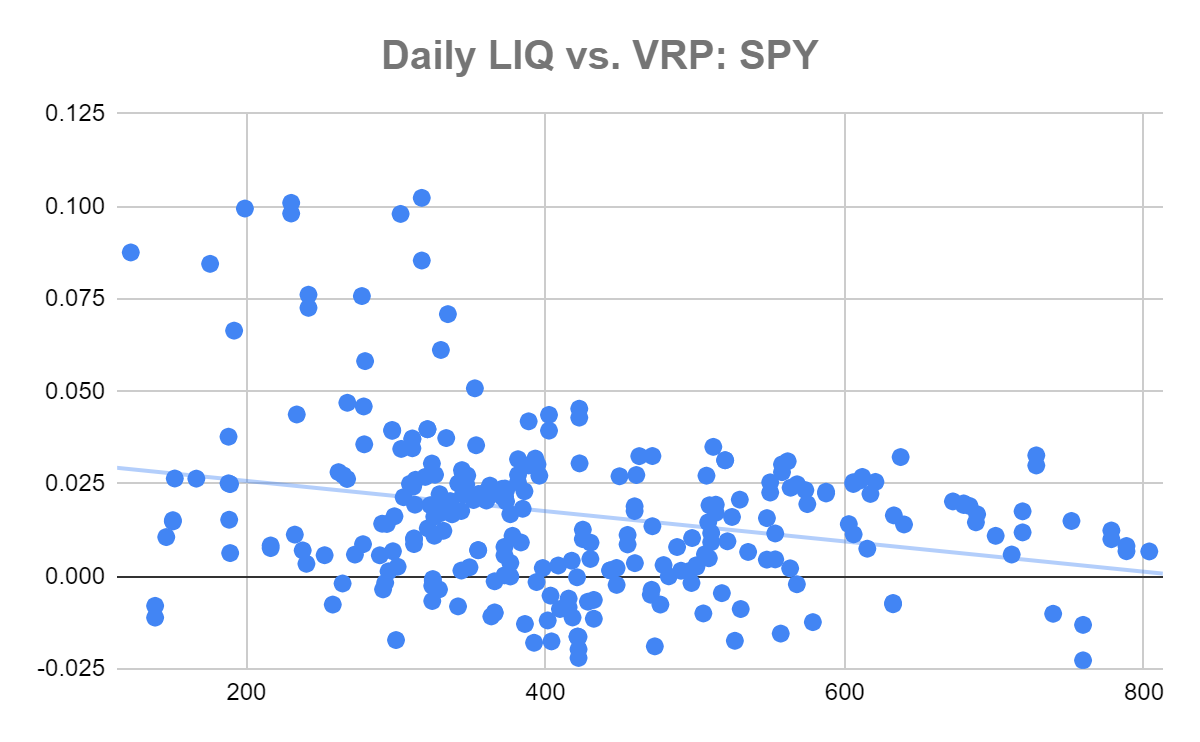

This relationship also holds on a daily level- albeit less strictly. Days when there are higher liquidity scores, tend to have options implied volatility prices be more predictive of future realized volatility levels.

An interesting notable here is the level of positive bias. Almost 80% of SPY readings are positive VRP at 30 days. A positive VRP - i.e. overpriced vol - tends to happen when there’s less liquidity. The average VRP when LIQ is below 400 is positive 2.34%. When LIQ is over 400 it’s only 0.97%.

The relationship is statistically significant, and for a 100 point higher liquidity score, you’d expect the VRP to be 40 basis points (0.40% vol points) closer to 0 VRP, or a perfectly efficient predictor of realized vol.

At least in indices they do… The below is ABNB, which typically sits around name 150 in LIQ rankings. The relationship is weaker, and we mostly see noise with LIQ readings clustered around 50-75.

Liquidity itself is fairly correlated to volatility, the explanation being that when volatility is high, that represents uncertainty and thus lower liquidity. That is, however a “low vol” phenomenon.

The above shows that generally for higher volatility issues, increases in volatility also give increases in liquidity (a positive correlation). For high vol, low liquidity names, a swoon in vol lead to jumps in activity and pricing efficiency.

The intuitive relationship holds strongly in high liquidity names. The correlation is -40% for LIQ scores over 100, meaning for top 10% of issues low liquidity comes with higher vol environments.

To complete the triangle, we know that VRP is correlated to LIQ across both the market and within issues. We see also that LIQ has a relationship with ATMVol30 levels, where the correlation between them is somewhat dependent on absolute levels of ATMVol30.

So does more VRP tend to come from higher IV levels? In SPY, that seems to be the case. On a macro level we panic more than what typically happens. High implied vol, most likely delivers high VRP.

That’s not so much the case in a name like ABNB. Implied volatilities levels are almost completely unrelated to the future looking VRP. Individual equity variance is an important risk factor.

Execute:

Reading this data at face value, seems to confirm the aphorism about keeping your head about you (selling vol) when everyone else is losing theirs (low liquidity). When liquidity is low, and implied vol is high, there seems to be positive VRP to collect - at least in high tier names.

While we only compared indices to one individual name, it’s important to distinguish the strategy across these two types of products. Highly liquid indices might have more predictive power in terms of the relationships, but they also tend to provide thinner margins.

The average VRP in SPY over the last year is only a little over 1%. By the time you consider execution costs, possible delta hedging, and cost of capital, the edge erodes quickly.

Using a signal like LIQ or ATMVol level may allow you to make more selective trades.

For individual names, the opportunities are much richer, but the relationships are more tenuous. Wider spreads mean you pay more, but it also means the market isn’t that sure of where pricing should be - which gives it a lot better chance of being wrong, and you being right.

As always with execution, consider risk managed spreads. Implied volatility versus realized volatility is a theoretical concept, but to make money you need an actual position. Condors give you a peace of mind that straddles don't, though you’ll have less net exposure.