Setting the Table:

All time highs. Dovish notes from the Fed indicating up to three cuts this year and boundless optimism about the future cash flows from equities has led the SPX to another set of unmatched peaks.

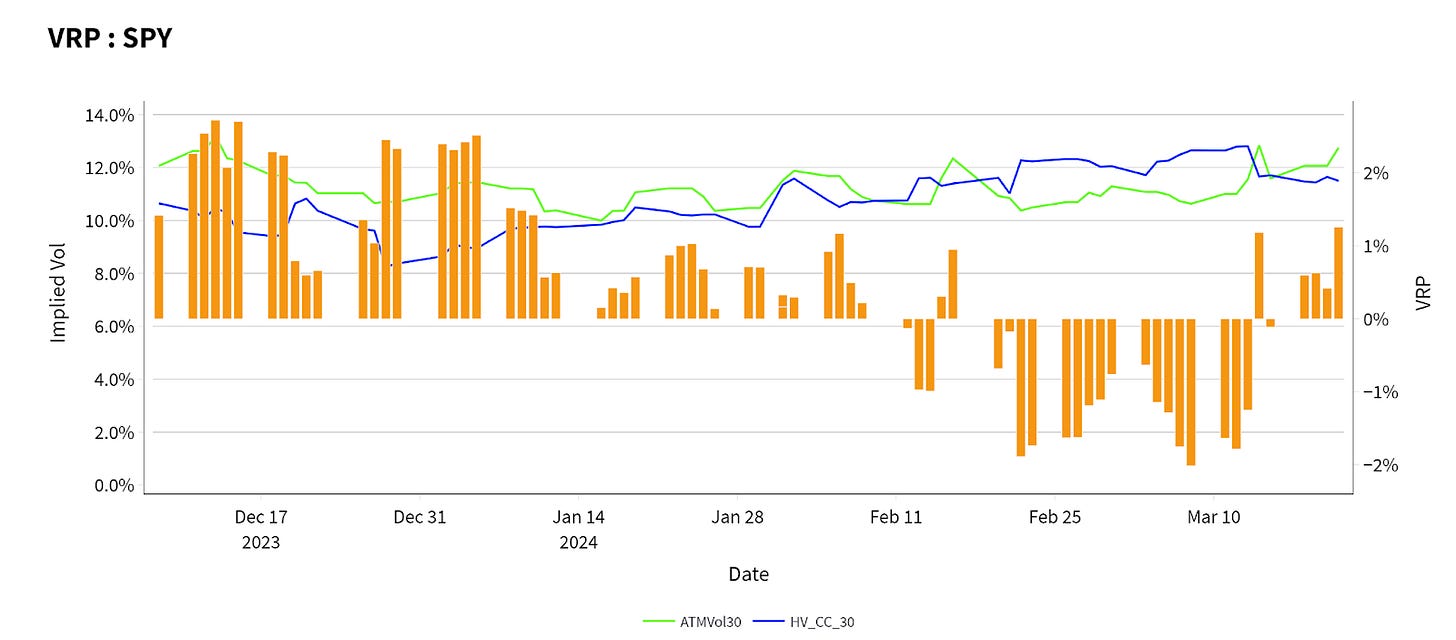

Near term vols are falling fast. The ten day curve in SPY is down almost 3 percentage points from it’s ten day average.

But not fast enough according to GARCH! The short term straddles are still a little bit over what the historical vol model thinks they should be.

We also finally have some consistently positive VRP materializing in SPY again. Nothing significant, but more of a reversion to longer term levels.

Identify:

In today’s edition of Portfolio Design, we’re going to talk about the high level process of building a trading strategy. The reason for coming to the markets is risk transfer. Returns are generated from your capacity to bear and manage specific types of risk. Options are a scalpel to transform underlying risk into a more precise exposure.

A common term that traders use - edge - is often misunderstood. The perception from the get go of retail traders paying “negative edge” by crossing the spread muddies the more important questions when buying or selling options. It’s hardly different than paying your grocer a few extra dimes for procuring strawberries.

Every trading strategy starts with defining what YOUR edge is. That’s a particular and personal question. It’s also not as complicated as it sounds. Edge doesn’t have to be an arcane structuring footnote you found in the prospectus, or a quantum vol model. For passive investors the main edge they have is time.

Options are stepping into the big kid sandbox, so unfortunately you need to do a little more work than buy and hold. The conversation has to start with what are you looking to achieve. Concepts like income, leverage, or protection are good buckets to parse objectives into, but the follow up question to all of them will be “what are you willing to risk?”

“How” you’re willing to risk is also important - what kind of path do you want to take. Everyone wants Bitcoin returns at $70k, but won’t touch it with a 10 foot pole at $16k post FTX. Planning for how you’ll react to the bad news is an important filter for a strategy. Don’t sell puts if you can’t handle assignment, and don’t buy NVDA calls 100% OTM with 72 hours on the clock unless you’re comfortable with lighting money on fire.

To round out the journalistic introspection, we must ask ourselves “why” we are willing to take risks. College tuition is a good answer, but the cogito ergo sum of a trading strategy looks more like what you believe to be true about how things work. Real estate investors like money, but they love buildings and believe they generate wealth. Momentum traders who love a good break out would make bad contrarians. Sticking to a strategy is hard enough - it’d better be something you believe in.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.