The Daily Theta Cliff

Analyzing and Replicating the Short 0DTE Trade

Setting the Table:

Equity markets have been cranky as all risk assets move in lock step with rates. The longer part of the curve (10 and 30 year) has continued to get more expensive and every macro data point is watched closely.

If equities are following fixed income, options markets are following equities. Volume has been relatively slow as volatility has been repriced slightly higher. One of the most difficult things about trading volatility is that it’s too high for a long time before it’s all of the sudden too cheap.

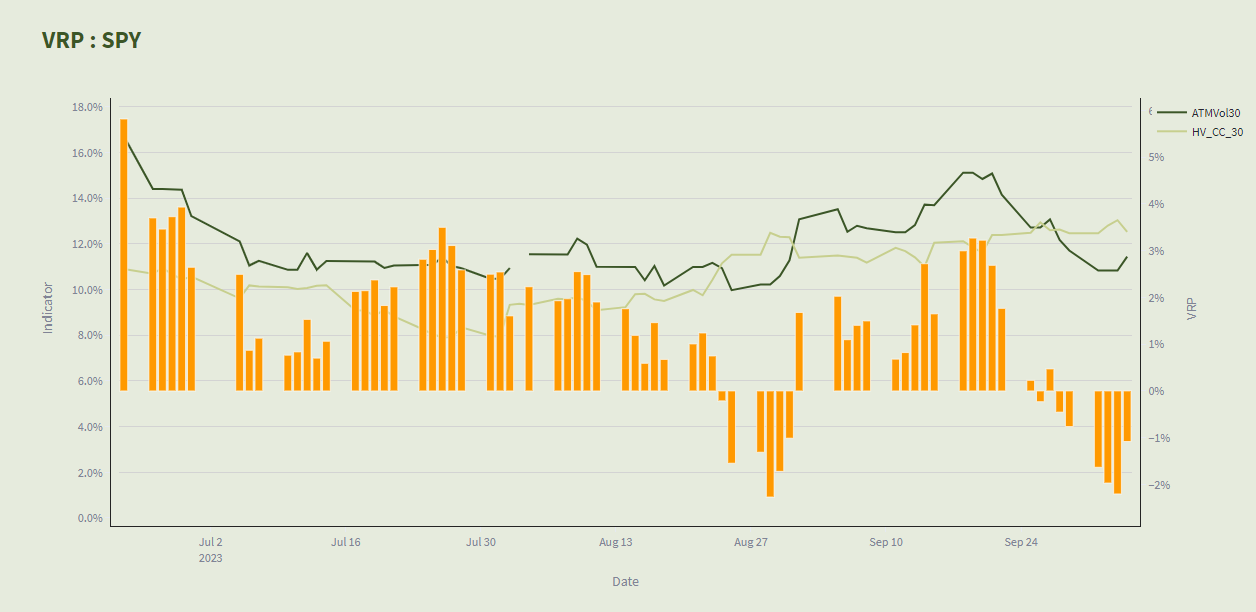

As realized vol was fairly low during the earlier parts of September, implied vol also fell. Selling that low implied volatility worked until the market woke up, and we’ve seen VRP flip negative as the market has started to realize more than an 11-12 historical vol.

ETFs are a brilliant innovation because they allow for a specific packaged strategy. (More on that bel0w.) Initially sector or broad index based, one of the more popular investing methods to track has been “factor investing”. Factors are attributes of a group of stock that’s orthogonal to the business - something like momentum, low volatility, or earnings quality. Quants will try to isolate and stack these factors to optimize returns - but that hasn’t been happening with factor ETFs. The WSJ investigates the degree to which these have been underperforming benchmarks.

What’s worse than underperformance? Worse returns with higher volatility.

Identify:

If we combine the power of an ETF wrapper with the most popular product in options in 2023, we get QQQY. This ETF was launched but three weeks ago and now has approximately $56M in AUM. The strategy? Sell daily options in the NASDAQ index options to collect premium.

The reason for targeting 0DTEs is likely two fold.

The first is for liquidity reasons. While options expiring in less than a month have always been very popular, those expiring within a day have exploded. Most options within a week are roughly $5 wide ATM in NDX, while they’re double that past two weeks out.

The second is to take advantage of the rapidly disappearing theta. By selling options with less than 24 hours on the clock - fewer trading hours - the idea is the fund can capture the steepest part of the decay curve. On a dollars per hour basis, the premium is the most expensive on the board. But that’s because anything could happen in those final buzzer beater minutes.

The distributions will go out to fund holders on a monthly basis, and the very first one was declared on 9/29 and was paid yesterday for $1.10. The fund launched at $20, and is now trading around $18.60. Net of the dividend, investors are down roughly 1.5%. The NDX is down a bit over 3% during that period.

Analyze:

The fund holds mostly a combination of Treasury bills and cash instruments, and then collects approximately 75bps of yield on a given day with its strategy.

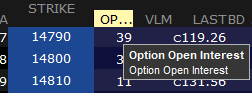

Today is October 6th, and as of yesterday’s close they are short 38 of the 14790 strike in the NDX. That was slightly ITM even at the close and the index is off in early trading.

A curiosity is they are also trading the XND index, which is the Micro Nasdaq at 1/100th the size. 24 contracts outstanding at a similar strike and for less than $3k in premium seems like a nuisance with almost no benefit..

Digging into the distributions a bit more, don’t believe the idea that this pays a 68% annual yield - that’s just $1.10 x 12 divided by the stock price. While it doesn’t sound like down 3% is the goldilocks scenario for this strategy - I’d qualify this as better than average.

Back of the envelope math says they had to take in about $3.5M in premium to pay their just over 3 million shares outstanding this dividend. Trading only 10 days before the declaration date, they had to earn about $350k a day. Based on the puts they’re selling, their gross premium collection is only about 50% more than that. Options don’t stay “mis priced” like that for long, we should expect some tail events to take a hit on capital here if they’re paying such high rates.

Unlike the tech stocks in the underlying index, this fund does benefit from higher rates. Half of their cash is in actual cash (likely margin posting) and the other half is in an equal split between three month and one year government notes. That's a 5.5% return tailwind on half the fund’s value.

While the NASDAQ is often mentioned in the same breath as the SPX, from a liquidity perspective these are massively different products. The first thing to notice about the below is the magnitude, SPX averages almost 4x the overall score. Further, SPX is driven by market width (dark green) while that’s much less true in NASDAQ. There is a dollar order of magnitude difference, but SPX is a dime wide and NDX is roughly $4 wide. 2 implied volatility points vs. .1 points.

To highlight that liquidity difference, it looks like this fund is all but one (38/39) of the contracts of open interest for today! In SPX coming in today the OI in the dailies was over 1000 on every ATM line.

That’s going to start mattering if this trade gets any bigger.

As discussed in “Execute” the decision over which delta to target is one of risk tolerance and ability to withstand choppier results. Ultra short term is good for higher premium collection, but this strategy can also be extended further out for less volatile results. Our Cash Puts report tracks how a 30 day and 30 delta option behaves. As you can see the premiums have risen steadily as stocks dropped and the overall volatility curve has shifted up.

If we’re focused exclusively on the Zero DTE options, we track the (more liquid ETF) QQQ for how the curve changes over time. Going into the trading day, what does today’s curve look like compared to the average of the last 10 trading days.

QQQ skew is several points higher across the board, though interestingly the mid section is up as much as the downside wings. That will give a little bump to whatever trade the fund puts on today.

While not tax advice, one thing to consider is how they structure this product for potential pass throughs. Broadly ETFs are more efficient than mutual funds because of the creation/redemption mechanism that obviates the need to sell actual shares in the holding company. But with options trading, the short term capital gains would still be passed through to investors.

There is a special exemption for “Section 1256 Contracts”, which are certain types of futures and options. These must be marked to market at the end of any given tax year, but they are eligible to be treated as 60% long term capital gains and 40% short term.

Cash settled index options qualify here, while typical equity options would not. This should increase the returns (or pass through loss offsets) for investors in the fund.

Execute:

Selling puts is a complicated process. The strategy sounds like it’s about theta collection, but at the end of the day it is also very delta focused. In other words you mostly make money when the stocks go up, not because of any special sauce in writing derivatives. Path dependency matters here!

As this past month has shown us, you can also make money when stocks go down if you’re collecting enough. Selling ATM and near ITM strikes here gives you a lot of juice.

If we look at the daily returns over their initial ten day window, there were four days the index was negative, and six it was positive. We’d roughly expect to collect all our premium on those 6 days. When it was negative, one day was only by 23bps, which based on the premium collections would still be a winner.

On other losing days, how far these tails go down matters. The index was down 140, 180, and 150 bps. Those felt like big days compared to the 15 vol we were implying last month, but this index can move. The inevitable path of a few consistent losers or one bigger one will happen eventually and change the return profile.

The Expensive Puts report highlights equity names that are trading relatively expensively. It’s a similar premium collection strategy, but we typically find much greater premiums (and risk ) than in indices. The downside is they are often only weekly opportunities, as only indices and top ETFs have daily options listings. This updates every 15 minutes during the trading day.

To replicate this more directly, consider the XND for smaller size but the same 60/40 benefit. If you’re going to be doing more size than that, the QQQs will have lots of liquidity and those dollars add up.

TERMS & CONDITIONS

Harvested Financial LLC (“Harvested” or “Harvested Financial”) and its members, officers, directors, owners, employees, agents, representatives, suppliers and service providers provides this content (this "Content") for informational purposes only. Use of and access to this Content are subject to applicable law and the full Harvested terms and conditions, including our Privacy Policy, available here: https://www.harvestedfinancial.com/terms-and-conditions.

Harvested Financial is a registered investment advisor (RIA) under the Investment Advisers Act. But use or access of this Content does not create a fiduciary relationship, unless or until you execute a written agreement to retain Harvested Financial as your RIA.

NO INVESTMENT ADVICE

The Content is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained in this Content constitutes a solicitation, recommendation, endorsement, or offer by Harvested or any third party service provider to buy or sell any securities or other financial instruments in this or in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this site is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in this Content constitutes professional and/or financial advice, nor does any information in this Content constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. Harvested is not a fiduciary by virtue of any person’s use of or access to this Content. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of this Content before making any decisions based on such content. In exchange for using this Content, you agree not to hold Harvested, its affiliates ,or any third-party service provider liable for any possible claim for damages arising from any decision you make based on this Content.