If there is one thing to distract the market from the election in just over a week, it’s the fact that five of the largest tech companies are reporting earnings this week. It’s Mag-7 all week long.

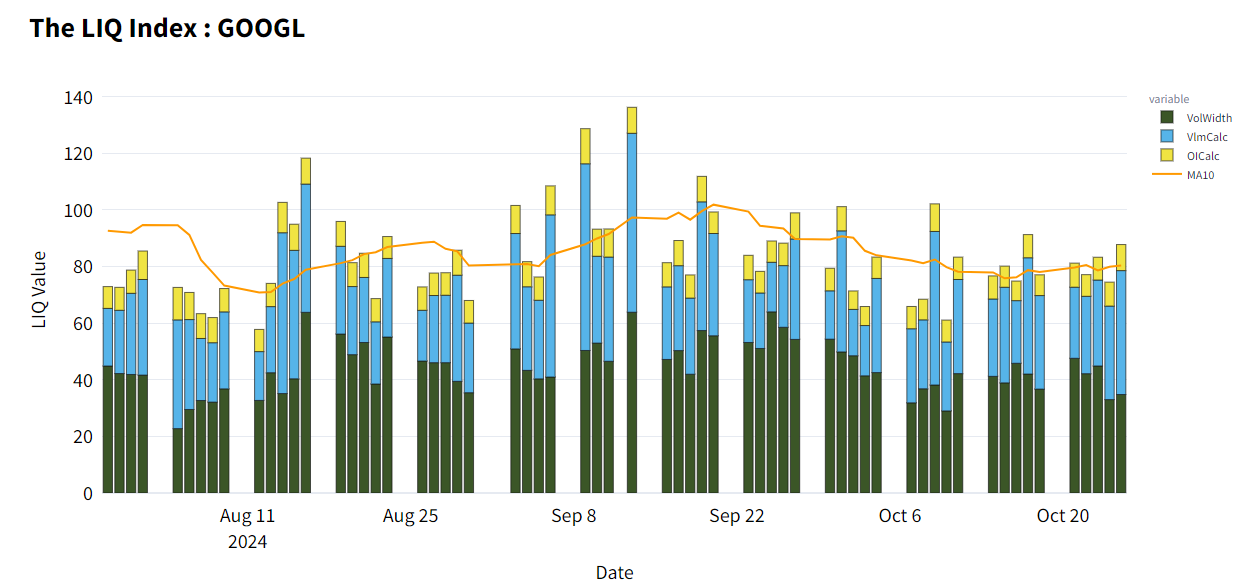

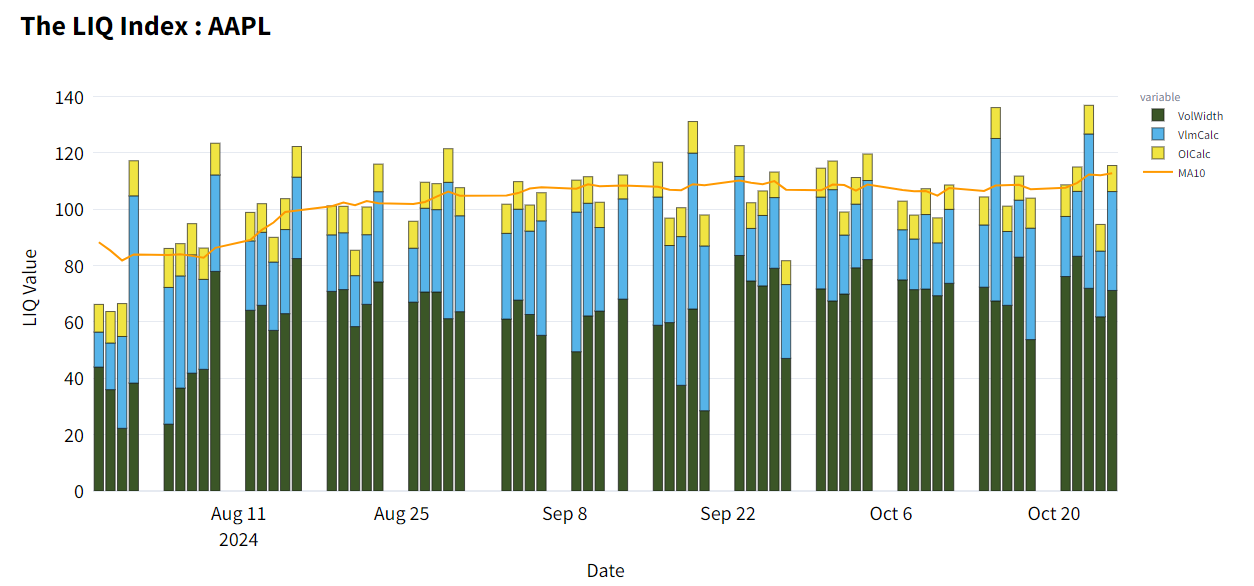

These are the household names that everyone loves to trade. While not exactly the top issues in terms of volume (GOOGL is all the way down at a lowly #30), the liquidity is nevertheless robust. And most importantly, it’s consistent.

We see AAPL and GOOGL maintain steady and elevated liquidity profiles thanks to their consistent market width and active volume/open interest turnover. It’s not just earnings season that everyone comes out to play. This is extremely important for anyone thinking about a trade here - you want to have opportunities to close, take profit, or just plain get out.

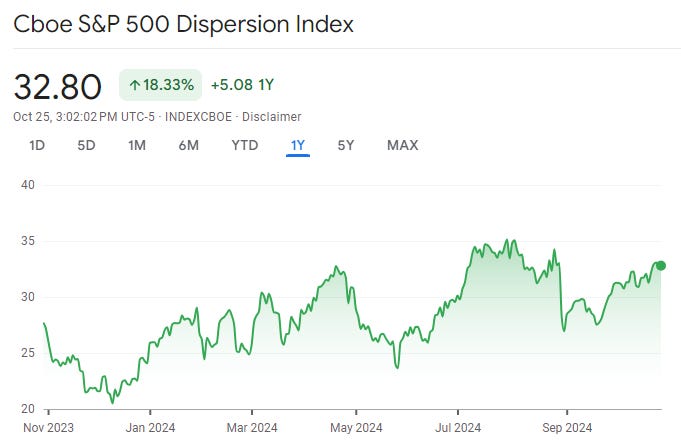

While they’re a significant percentage of the index market caps, each of these stocks will have their own unique results. That creates some tension in which direction the broad market will go, and we can track that via the DSPX dispersion measure.

Things aren’t quite as elevated as they were last earnings season. AAPL is the only company that has seen negative revisions in their predictions over the last thirty days, with everyone else flat or very slightly positive.

Heading into the event, there are a number of different options positions to take. As we discussed with the Sling Shot two weeks ago, any earnings trade is about managing around the market’s expectation of movement. We all know somethings going to happen, but is it more or less than we expect?

This week in 50 Ways to Trade an Option, we’re going to look at risk managed ways to take advantage of elevated implied volatility and its inevitable post-earnings crush.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.