Setting the Table:

The S&P 500 and Nasdaq are both officially up on the year after a string of positive sessions this week. Even with the CPI readings yesterday coming in a bit hotter than some expected, the market saw a steady bid.

The Bitcoin ETF “Cointucky Derby” kicked off in full force yesterday with nearly $5B in trading volume, blowing away all previous records for ETF launches. This is despite the fact that major brokerages like Vanguard are preventing clients from buying. Currently these ETFs are trading at a small premium to NAV (1-2%) but it’s much less than many expected.

Options will be eligible to be listed on Thursday January 18th after 5 days of price history.

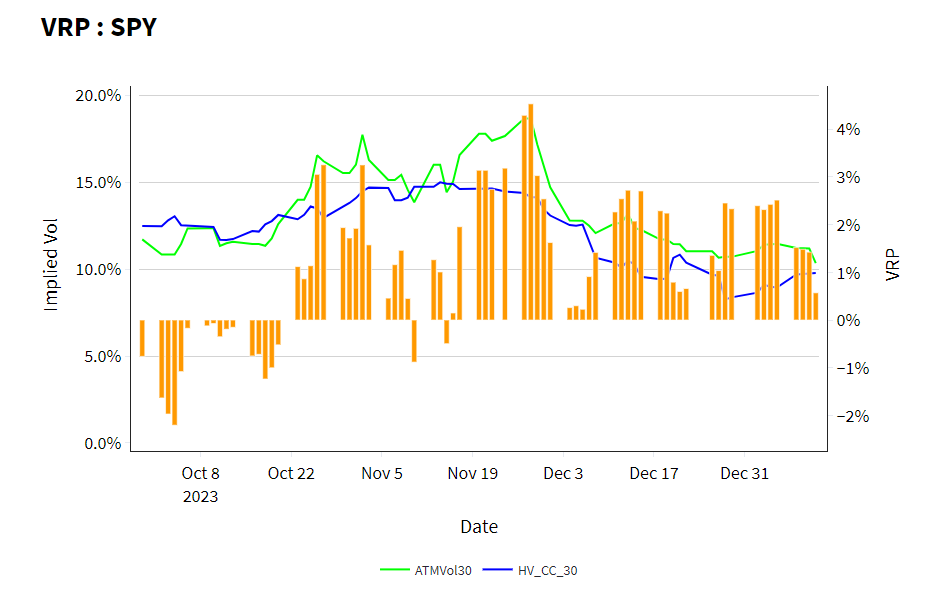

While the first week of 2024 might have disrupted the lullaby of the end of last year, after a second week things seem to be settling back into the same program. Implied volatilities in the main complexes continue to sink, and there has been a very consistent volatility risk premium.

One of the things that this implies is that options are well priced, and there aren’t a lot of exogenous shocks. Things are happening, but they’re all within the range of what 12 vol in SPX or 15 in NDX expects.

If options are well priced, that is a good time for strategy execution, because it means tighter spreads and less slippage on execution, but also confidence in well estimated pricing.

Since the start of December, we’ve been seeing almost no instances of vol being too low (negative VRP) and fewer spikes to the upside either.

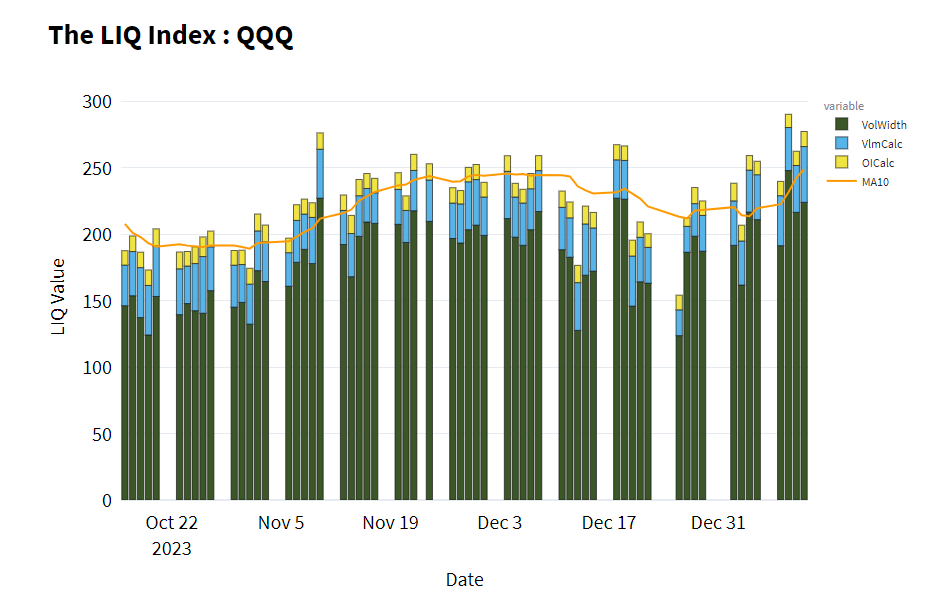

QQQ liquidity is as strong as it gets. While it doesn’t have the absolute tightness and volume of SPY, readings pushing 300 are double its best components (AAPL, MSFT).

Identify:

No matter what type of strategy you are executing, position management is critical to success. This includes sizing on opening, as well as take-profit and roll levels.

I hesitate to use the word “stop loss” here because those can be difficult to implement with options. While functionally identical to a take profit order, I would categorize the major difference as being short or long “execution convexity”.

If you are trying to capture a profit, and the market “spooks” and hits your bid or offer, that’s a good thing. If the market “spooks” and takes out your stop loss before settling, you’re much more likely to have a bad fill.

While it’s important to have theoretical stop losses and various price levels that you have objectively identified as important times to review your allocations, putting out actual orders risks adverse selection.

In order to help clients and users track their positions, we’ve been building out tools to send alerts when certain options or spreads hit notification levels. The first report to have this is Expensive Puts, which is now live. We’ll be rolling this out to other audits as well as a market wide spread building tool.

Scroll to the bottom of the report, and you’ll see the below interface. Simply enter your e-mail (and US Phone number if you wish to receive texts) and identify the option you wish to be alerted about. The selection is the specific list of Expensive Puts in the audit displayed above, but we will be expanding this.

Setting your alert type to “Increase” will tell you if the “Fair Value” (FV) of the option is trading at a price greater than the percentage threshold over your entry price. The default entry price is the current fair value, but you can override that with your exact execution price.

We use FV here to help with wider markets, and to also recognize that bid/ask spreads aren’t perfectly indicative of where you’re likely to get executed. Depending on the liquidity you’re likely to pay a few pennies more or sell a few pennies cheaper, so that’s important to bake into your alerting levels.

We scan the market every 5 minutes to identify which options are moving, however we’ll only send you one notification per day if it hits the trigger.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.