Setting the Table:

As we head into the long weekend, markets have already taken off. News is out, stocks are gently up and vol is softly down. For now.

Not much planned for the next week - the ten day curve in SPY is a full point lower across the board from the 10 day average.

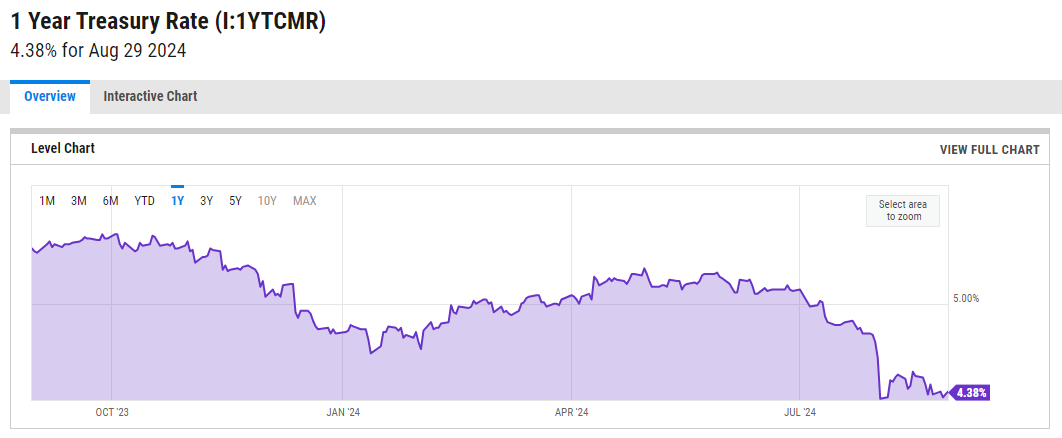

The SPX is up 17% on the year. Implied vol is 12% for the next sixty days. The presidential election adds 1% to the 90 day and greater figures. Rates aren’t quite at their highs, but the 1 year bill still yields 4.4%.

If you’re long - most of us are - this has you worried two fold. Things can always go down. But if I hedge, trim, or time the market here - what if risk assets exploded on lower interest rates?

Here’s the trick - do just a little bit. Sell a few shares and see how it feels. If you want to buy an options hedge structure, only cover part of the position. Even accounts holding less than round lots can benefit from spreads like broken wing butterflies or backspreads to get precisely defined amounts of coverage.

And if you are wondering how to deploy cash but waiting for a dip - here’s a way you can almost get your cake and eat it too. The OWL can give you many different dimensions of equity exposure all with a (US Government) guaranteed principal. No two options - or OWLs - are alike.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.