Setting the Table:

The start of the new year couldn’t be more different than the way we ended last year. This week the big tech names - particularly AAPL - that drove the rally into the close of 2023 saw a rude awakening.

Much of this seems to be related to tax selling, but simple rebalancing and reallocating outsized risk profiles within a defined framework would cause this too. If a position does well, it inherently becomes too big of a part of your portfolio.

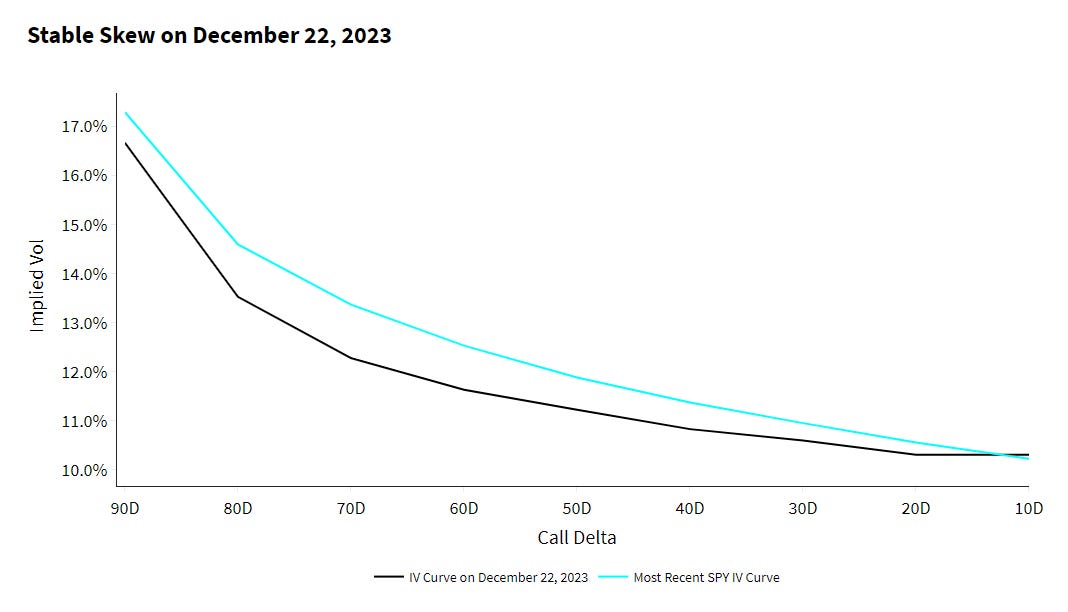

Volatility has ticked up slightly, but we’re not in panic territory yet. ATM vol at the 10 day range below in SPY shows we went from roughly 9.4% to 10.8%. That's a “jump” but we’re talking about very short dated options. People are pricing more noise in the next little bit.

On the “longer” dated options, the curve has moved much less 30 days out. ATM vol has only gone from 11.2% to 11.9%. In expected daily moves terms, that adds less than 2 points to the SPX range.

Overall liquidity in the market is stable, if not excellent. The last three days of January are a tight range. That darkest green bar of market width is better than the worst of last quarter, but relatively lower volumes (at or below last year’s average of 44M) has pushed spreads out.

As we turn over the new year, there are both rebalancing flows, but we quickly get back into earnings season too. In less than 2 weeks AA kicks off the next round of reports. Both of these are likely to contribute to overall market dispersion.

The below chart shows the VXAPL in green (VIX methodology applied to AAPL), compared to the benchmark SPX based VIX. As you can see, after moving in lock step for several weeks, recently there’s been quite a breakout. Over the next 30 days, investors are expecting a lot more variance in AAPL compared to “usual”.

More broadly this same trend is showing across all stocks. The CBOE Dispersion Index tracks the net of the variance of individual components (e.g. VXAPL) and the composite, which is represented by the VIX. This bottomed in December when the market was moving in lockstep, but has quickly started to increase, as it is forward looking for expected variance over the next 30 days. DSPX is saying get ready for a stock pickers market. Note that it was last elevated anticipating earnings season.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.