Setting the Table:

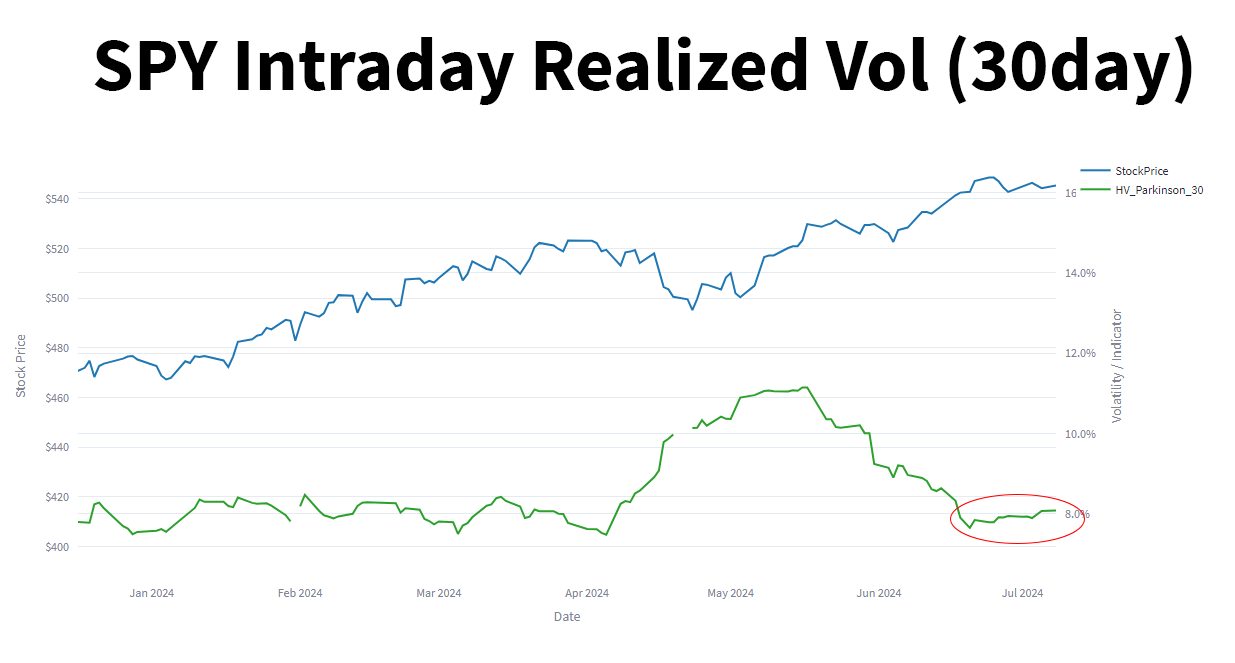

Summer volume doldrums are here. The OCC only traded 42M contracts yesterday, 10% below the annual average, and both the SPX and NDX had tight intraday ranges.

After decent intraday moves for much of April - June, we’re back in a slump of a daily range.

Futures are set again for a muted open, though we continued to drift upwards. This type of market suggests short vol, long delta structures like broken wing butterflies or defined risk credit spreads.

For our volatility based indicators (VRP, IVnetHV) we’ll turn to identifying slightly longer term hedged equity trades. Our screener is based on the readings of the GULL90 indicator, and we set our vol readings for 90 days to match this (ATMVol, IVnetHV, VRP).

While equity markets are placid, there's been some solid churn in the crypto space. Bitcoin price action has led to volatility with the miners, and two of them jump out in our vol screens this week: CLSK, and MARA.

In both of these cases we look to use the high implied volatility levels to create hedged bullish positions that afford both significant protection and upside potential.

Yikes: UVIX

Sitting at the top of the GULL90 readings is UVIX, the 2X long futures ETF.

There are a couple of words of caution from this reading. The first is our typical warning about strike selection. With a low dollar stock, these always get dicey. The downside puts have very little bid, and even trying to buy the $3/$4 put spread will be difficult.

Buuuuuut….. You do get a lot of upside. If vol starts to pop, this does afford nearly 100% gains. You might ask yourself - how much lower can vol go?

The second warning is about underlying products. Anything that's a “derivative” fund is going to have some wonky behavior. Whether it’s futures, options positions, or swaps in the ETF, trading these products has additional risk. For UVIX in particular, we know there is a futures roll which costs the fund carry on a daily basis to maintain its position.

At Portfolio Design, we track opportunities through four different lenses: Volatility (VRP, IVNetHV), Liquidity (LIQ), Momentum/Mean Reversion (Bollinger) and Dividends. Each of these filters represents a different approach to investing, and can be used independently or in concert.

With these frameworks in place, follow along here twice a week as we dissect what the screens are telling us for Covered Call and Hedged Equity structures. Identify both short term trading and longer term investment opportunities. Free subscribers get a taste with “YIKES” and paid subscribers get analysis on the details of these opportunities, along with the full screener results.

Data comes from TheTape.Report where users can build their own screens and access a full suite of options indicators.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.