Hedged Equity: QQQ, BAC, MSTR

What liquidity and strike availability mean for multi-legged protection

Setting the Table:

For a midsummer Monday, volumes were booming: 10% over the annual average. We have strong reporters early in the earnings season, and it’s no wonder that volatility markets are asleep. Uncertainty is making itself scarce.

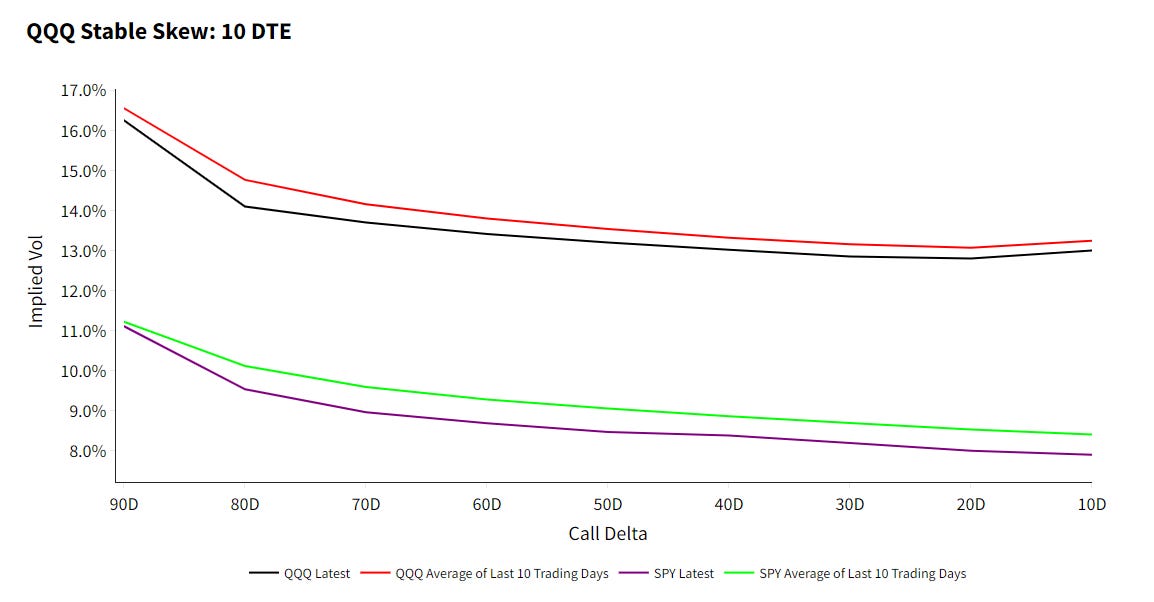

While the curves at the 30/60/90 day levels are fairly close in line with their ten day average, the near term continues to find ways to drop lower. This is much more notable in SPY than QQQ, where ATM vols dropped 2x as much.

Notable also is that QQQ still retains that bit of upside call skew, where the 10 delta strike is trading over the 20 delta strike.

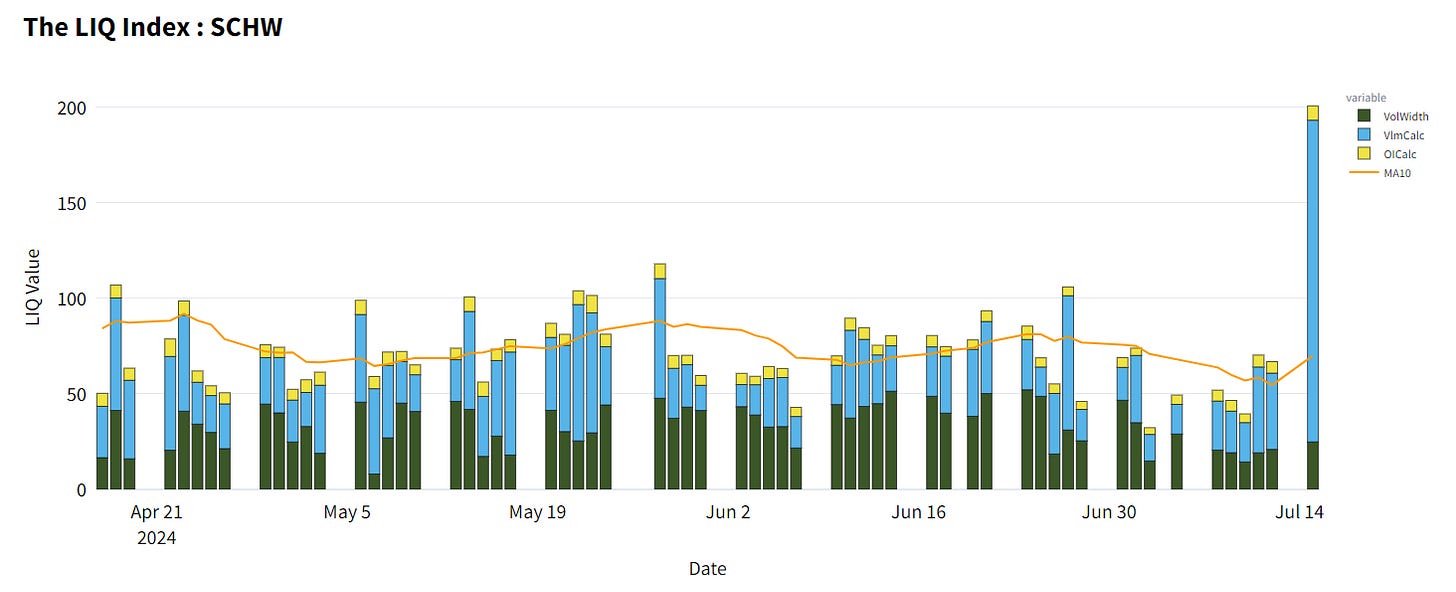

Yesterday’s market seemed all about politics, and you’d be forgiven for expecting to see DJT at the top of the LIQ charts. It had a top 5 volume surge, but it was bested by anticipation about SCHW earnings. All the banks so far have been strong, and the same is expected from this brokerage pioneer.

Another notable difference - markets are about 10x tighter in SCHW than DJT.

Our lens this week is liquidity and LIQ, and names like DJT or SCHW show how volatile these readings can be. For the Hedged Equity (GULL90) structure today, we will be looking out slightly further to 90 days for our indicators.

An important part of the GULL setup is being able to find the right strikes. Strike listings usually follow LIQ, but not always. Because of the listing procedures, this can often be a lagging indicator. The right strikes in your desired expiration make the difference between a feasible and unfeasible strategy.

Coming Soon: Strike Score

A new way of comparing issues and expirations for strategy selection. Liquidity means tight markets and high volume, but that only gets you so far without an actual strike that fits your strategy.

The StrikeScore measures the average distance listed strikes are from a theoretical delta target. This can be compared by expiration, or for the whole issue.

Start a free trial to read the upcoming research piece on StrikeScore.

Yikes: MSTR

As the election odds shift distinctly towards the Republicans, crypto prices have been rising in sympathy. Broadly the party has been seen as more sympathetic to the industry, and Bitcoin specifically is closely tied with MSTR.

If we filter our screen this week by LIQ22D (the current LIQ reading compared to its 22 trading day average), MSTR isn’t the absolute highest, but the past two days have been roughly 74% over the average.

The GULL reading of 41.9% is elevated, to say the least. This is one of those readings that suggests adjusting the strikes to give more downside protection. With ATMVol readings over 75%+ - it’s prudent to ask for more than the default 5/20% downside protection level.

The below example gives us the 5/40% downside, yet still 22% upside.

Even if LIQ isn’t world class here (though still top 1% of options issues - shows you what’s out there…) the strike selections are truly excellent. Part of this is the high dollar amount, but for any given target delta (1-99) there will be a strike within 2 deltas - across all expirations.

For all target deltas expiring this year, there is a strike within a half of a delta. That’s not just yikes, that’s wow.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.