Hedged Equity: IVNetHV and VRP Differentials

How strike selection impacts fundamental and opportunistic trades

Hedged Equity (GULL): IVNet HV + VRP

This week we’re focused on identifying opportunities through the lens of implied vs historical volatility differentials. As we saw yesterday with Covered Calls, even in low volatility environments there can be notable gaps between these two metrics.

We can look for high differentials as an opportunity for premium collection, or alternatively low differentials as indicators of steadier investment structures.

Both COVC and GULL trades are overlays that win when stock goes up. For this reason we always want to pass a second “quality” filter over any stock selection.

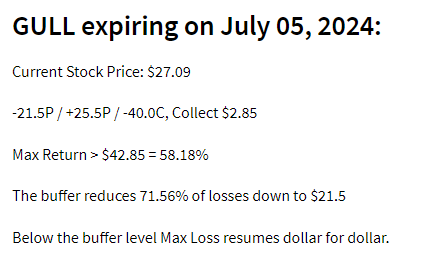

With the GULL, part of the indicator measurement is a function of the shape of the curve. The call level is determined by the price of a fixed put spread. Because this put spread is fixed in percentage space, the call distance out of the money will vary based on volatility and skew levels.

Another consideration with the GULL is getting appropriate strike levels. We have three different legs that we need to find, and listings must match the objective. The indicators will signal potential names, but we can see adjust the strikes for quite different trade setups.

YIKES: GME

GME has roared back into the news as Keith Gill riles up the meme stock army. The 30 day reading is 98.4 and the 90 day reading is 144.

Strikes really matter in names that have jumped around. The $40 strike is the highest in July - so far. It’s looking like more will become available today - check back later to see how options have expanded.

Also NB, an option expiring on July 5th is a tough trade - markets after a holiday are unlikely to be particularly liquid for a closing trade here.

Opportunistic: BYND

Using the GULL for opportunistic trades can take two different vectors with IV differentials. We can use expensive premiums to capture additional credits on entry, or we can use it for expanding the amount of upside in the trade.

BYND is seeing a very elevated GULL in the near term - though earnings won’t come again until August. Unlike most of the other names in our screener with high GULL values, here we see both positive VRP and IVNetHV.

While that GULL value is elevated, it’s not exactly what you’ll capture in the markets. For our nearest fit, because of the downside strikes being set at +3% and -22%, you get a lot more buffer, but less upside.

While $0.50 strikes seem close, the gap between strikes represents 6.5% of the stock price - in SPY it’s only 20bps.

We can cut the buffer by dropping the protection strike, and see our upside potential explode. The decision between the two will depend on your expectations for BYND. Both premium collections/payments are relatively small.

Another item to pay attention in BYND is the market widths - particularly at this 30 day expo.

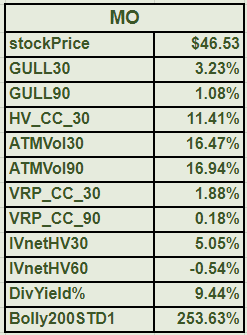

Fundamental: MO

Flipping the screener upside down, instead of looking for names with high GULLs, we’ll look at the lower range for more stable stocks that still might have shifting volatility regimes.

Here the IV and VRP readings are very flat, which indicates fairly stable options pricing. Further, we see a strong trend with the high long term bollinger band indicator. Finally, the dividend yield is robust which a protective overlay like the GULL covers.

While a GULL gives very low upside in a fundamental investment case, the value add here is the downside protection and isolation of dividend yield.

For fundamental cases we like going out slightly further, and the closest expiration to 90 days is the September 20th at 104 days.

Our nearest fit is a very tight GULL, but remember between now and Sep there are June and September dividends priced in of nearly $1.

To capture a credit, we’d need to go down ITM to the $45 strike, but alternatively for only $0.02 more we can trade up to the $50 strike and give ourselves quite a bit more room to run - 6.7% vs 1.4%.

SUBSCRIBE TODAY TO SEE THE FULL SCREEN AND GET ACCESS TO THETAPE.REPORT

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.