Setting the Table:

Prices whipsawed last week, but landed up just over 1% after Powell waxed appropriately dovish. The first half of august was a decline that paralleled interest rate cut expectations. Now that summer camp in the Tetons is over, the market has adjusted to slightly lower cuts.

Swaps are now pricing about 32bps for the September meeting (down from 50 at the beginning of the month) and over 100bps by the end of the year.

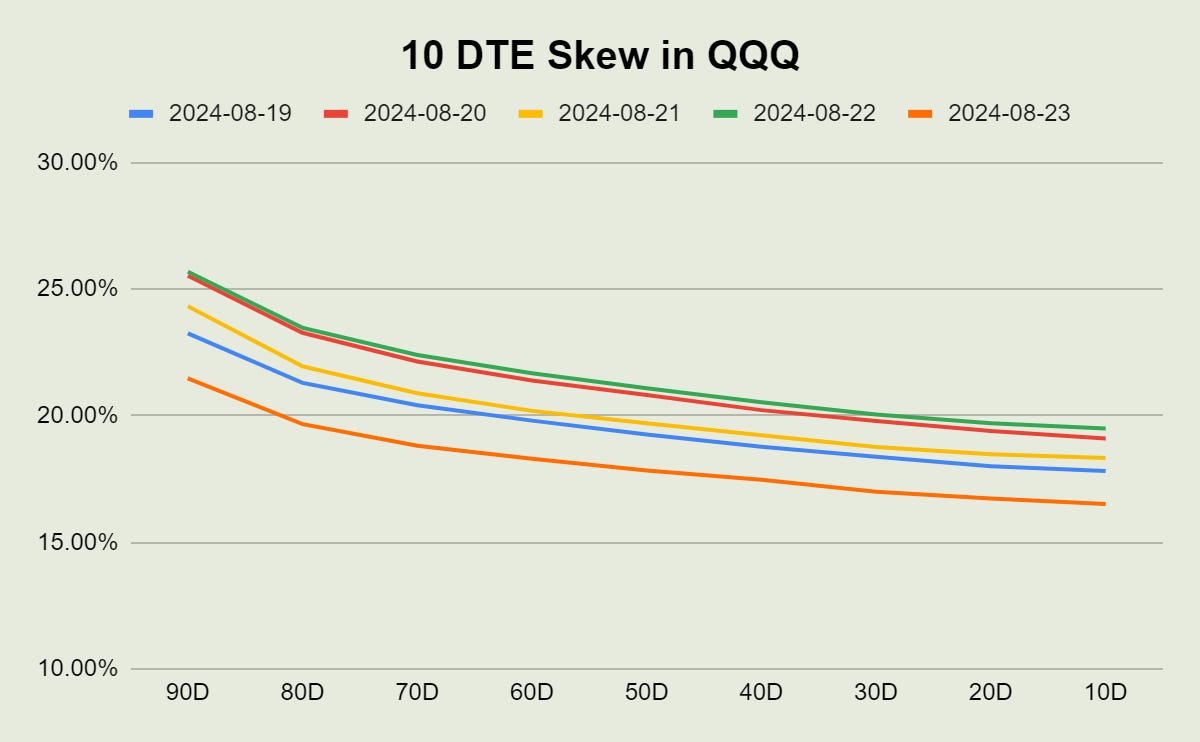

After flirting around early in the week, short term skew closed distinctly lower after the speech. The steady 10 day values at fixed deltas showed little change in shape, but dropped at full 1.5% points at the money by the close Friday.

The exact same dynamic happened in QQQ also, though a bit more exaggerated moves up and back last week.

Liquidity throughout the week also stayed solid as traders processed a relatively surprise free week.

With rates headed back down in the next 1-3 months, there are two reasons to consider dividend focused stocks. First of all, steady dividend payers are likely to have more robust business models to weather some of the choppiness that’s likely as monetary policy adjusts. Secondly, buffering some of this volatility with hedged equity or other overlays provides premium conversion opportunities. Do you prefer it the cash or protection?

Working on a trading plan? Harvested Financial conducts bespoke trading workshops to think through a new strategy or portfolio reallocation. Topics can include stock selection, overlay implementation, and much more.

Whether you’re a professional or individual, we’re here to identify, analyze and execute on opportunities.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.