Covered (Commodity) Calls: USO, GOLD, RILY

Moving time and strike parameters based on opportunity

Setting the Table:

As expected, yesterday’s session was a low volume snoozer with little movement- less than 41M contracts traded hands and SPX/NDX were basically flat.

The volatility surface at 30 days in SPY looks nearly identical to Friday’s close. Overall, we are very slightly higher ATM, and I would attribute most of that to the event vol around this week’s CPI release.

We can see the straddle prices have barely decayed at all over the weekend either. Looking at Wed/Thur/Friday expirations in SPY, there has been only minor price decay. SPY sees a lot of the move coming from CPI on Wednesday, but jobless claims on Thursday should also have an impact. The weekly move is currently expected to be just under 2% of spot.

The WSJ’s Mackintosh said it yesterday, and today Bloomberg’s Authers confirms that “all eyes are on CPI.” The market is expecting a very aggressive cutting dynamic over the course of 2025.

New Features at TheTape:

Expensive Calls and Puts now have completely customizable filters. Choose any delta, dollar, or DTE range to run the “Expensive” algorithm and find the priciest options - on LIVE data. Refine the results by eliminating 0 OI/Volume or leveraged products. Choose whether you want earnings results or not.

The COVC/CSHP (Covered Calls and Cash Puts) page also has improved colorways, in addition to a new tool that lets you compare relative pricing in two issues over time.

Screener has updated charting with new colorways and indicators, making indicator comparisons even easier. There are also default column groups - allowing you to follow along directly with the filters and lenses we use here at Portfolio Design.

Check out all of this and much more for free at DemoTheTape.com!

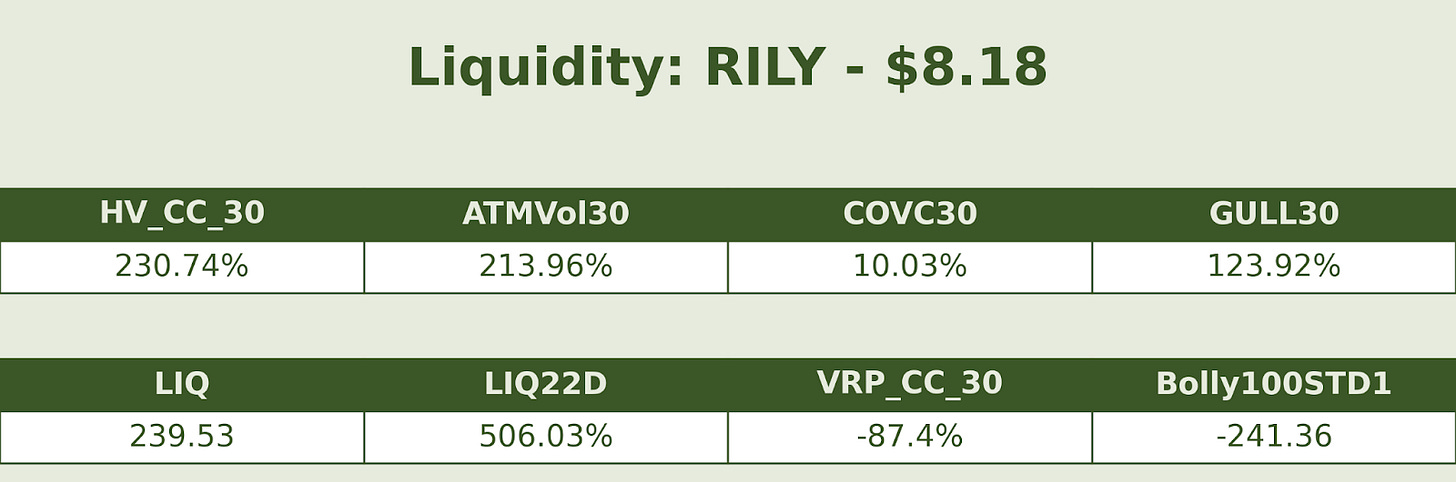

LIQ exploded yesterday in RILY, but not for a particularly good reason. For the third quarter in a row they missed their quarterly filing deadline, and stock was down more than 50%.

N.B. This LIQ is entirely driven by volume. 142k contracts yesterday is more than 5x the recent average volume. Spreads are still VERY wide in vol terms - like 40% wide.

While the high vol here has often been a good sale in put space - they’ve tested $15 many times the past year but only broke it yesterday - here we’re looking at the calls.

Stock is already down another 10% this morning, so you’ll need to recalibrate once the market opens, but pulling in days to expiration and delta makes sense here. Once you get over 200% vol, with a landmine field of events ahead, it makes sense to think in dollar terms.

By selling the ATM calls, you can collect 8/15/24% of the stock prices premium just to see it stay stable.

While Max Returns go up quickly at each successive strike, remember you’re leaning increasingly towards a delta play here. Do you really think this rebounds strongly?

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.