Setting the Table:

Markets have swooned on the Fed’s relative dovish-ness and the NDX has erased all of last year’s losses. AAPL traded within $0.30 of $200, Bitcoin is solidly over $40,000 and the OCC turned around 70M contracts yesterday; things couldn’t be more different than a year ago.

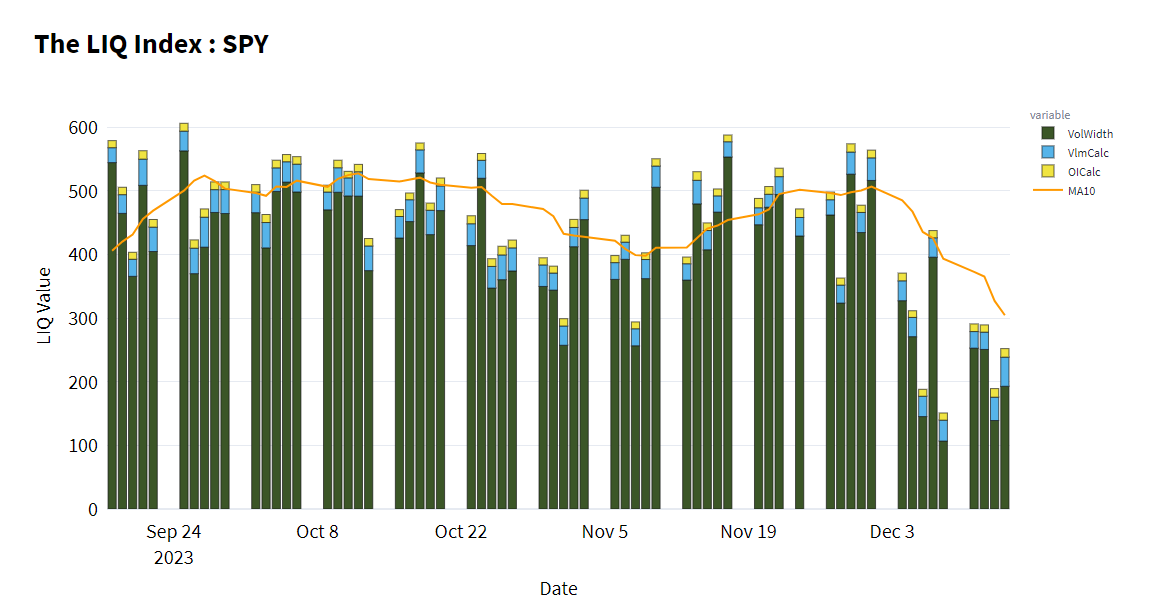

Liquidity has been relatively weak going into the end of the year, despite the market’s continued rally across nearly all risk asssets. Dealers are widening out spreads as seasonality, macro, and whatever else is taking control of the markets.

Identify:

With the end of the year coming up quickly, it’s a good opportunity to think about rolling positions, rebalancing allocations, and generally doing some portfolio maintenance. Whether you’re looking to use your money next year or next decade, keeping your exposures in line is an important part of investment management.

With a simple underlying portfolio of 60% stocks and 40% stocks, we might have to sell a bit of the outperformer to buy some of the under performer. But with options strategies, we have a constantly evolving risk structure that requires both ongoing and end of life maintenance.

What separates options from other investment strategies is that they have a finite duration. Their value - or lack of value - is a function of time left on the clock. Probabilities are only worth something when there are opportunities to realize them. Your equity position will always represent 100 shares no matter what the price of stock is, but the covered call you sold will provide widely varying degrees of “offset” depending on where the stock price is and how far away expiration sits.

Below we’ll analyze the various indices that we track at Harvested Financial to help time and evaluate equity overlay opportunities.

Keep reading with a 7-day free trial

Subscribe to Portfolio Design with TheTape to keep reading this post and get 7 days of free access to the full post archives.